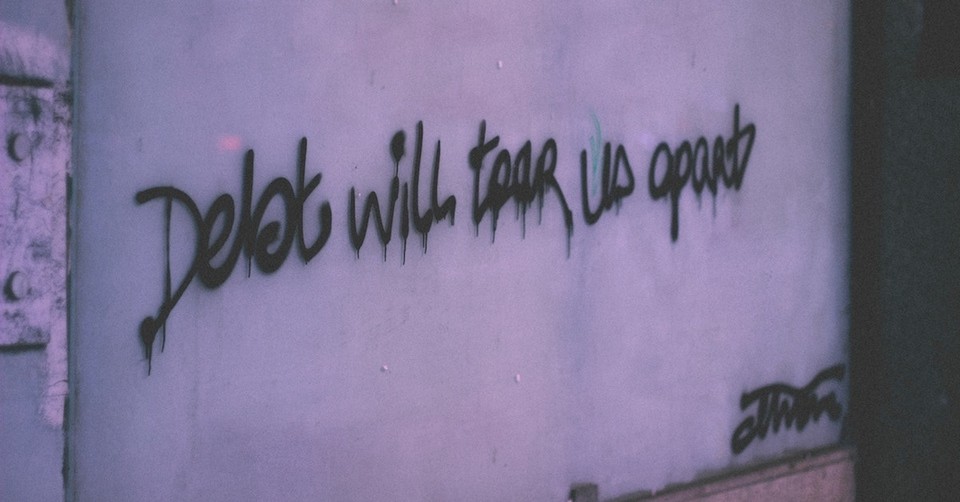

It’s Official: Most Christians Are Currently in Debt

The latest statistics reveal some shocking numbers: approximately 80% of all American are in debt. This figure holds true across the board from Baby Boomers to Millennials. Because of this trend, current data predicts that as many as 73 percent of Americans will ultimately die in debt. Because about 50% of Americans identify themselves as evangelical/Protestant Christians, this means Christians are part of the equation. If that’s the case, debt is an issue the Church should not ignore.

As believers, we have a responsibility to transfer Christ’s teaching into our day-to-day living – including his teachings about money. So what does the Bible have to say on the subject of debt and all that comes with it?

Photo Credit: Thinkstock

1. God Asks Us to Have No Debts

“Give to everyone what you owe them: If you owe taxes, pay taxes; if revenue, then revenue; if respect, then respect; if honor, then honor. Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law. (Romans 13:7-8)

A strict interpretation of Romans leaves little doubt that owing to another is wrong. While this can seem harsh, there’s also a significant amount of love in this passage. Another perspective of the lesson is to think of debt as getting in the way of your relationship with God. If a debt is all-consuming, it may keep you from fulfilling the covenant to love one another and God above all.

Photo Credit: Thinkstock

2. Poor Money Management Can Make You “Worse Than an Unbeliever”

Many Americans report financial hardship due to a medical emergency or job layoff. But many Americans fall into debt due to irresponsible management of money, which can significantly affect their family.

Ask yourself: Are your spending patterns such that credit holds significant power over your life? Pray on the reasons for your debt and reflect on whether or not they take away from your life as a Christian. Proverbs 22:7 warns, “The rich ruleth over the poor and borrower is servant to the lender.” 1 Timothy 5:8 is another passage to consider: “But if anyone doesn’t provide for his own, and especially his own household, he has denied the faith and is worse than the unbeliever.”

Photo Credit: Thinkstock

3. Ask if You are Consumed with Debt Repayment

An alternative take on debt getting in the way of your life as a Christian is whether or not you are obsessed with repayment. Taking on a second job, selling off worldly possessions and avoiding self-care tasks which might be interpreted as luxuries can be all-encompassing as well.

Prayerfully, let God show you the path to debt relief. He will do so with love, directing you to the resources you need. And just as countless biblical examples illustrate: be proactive. There are several resources on debt management you can check out.

Photo Credit: Thinkstock

4. Having Less (in Peace) is Better Than Having More (with Strife)

Regardless of your debt situation, God wants you to work toward economic strength so your spirit can be free. Exhibiting restraint, mindfulness and understanding when to say “no” are tried-and-true ways to achieve the balanced goal of freedom from debt.

“Better a dry crust with peace and quiet than a house full of feasting, with strife.” (Proverbs 17:1)

Photo Credit: Thinkstock

5. Consider Settling with Your Lenders

When, with prayer, you recognize an off-balance relationship, consider releasing the stress of being in debt from your heart and work towards a partial payoff solution. Negotiating for a smaller balance and setting up a realistic payment plan should take the pressure off both you and the lender.

Consult with a debt settlement firm or an attorney if you feel tentative about your mediation skills in this situation.

Photo Credit: Thinkstock

6. Purposefully Change Your Path

Going forward, honor your learning experience and purposefully set forth a plan for improvement. Wherever you stand now, it’s always prudent to create a realistic household budget and vow to stay within its parameters in the future.

“Brothers and Sisters, I know that I still have a long way to go. But there is one thing I do: I forget what is in the past and try as hard as I can to reach the goal before me.” (Philippians 3:13)

Photo Credit: Thinkstock

7. Invest in Enterprise

Taking long-term goals into account, the Bible does allow for the borrowing of funds as a means to the end of financial instability. Consider the Widow’s oil. In 2 Kings, Elisha counsels her to borrow bowls for her oil, so she can sell the product and earn a living for herself and her sons. But he cautioned that she must repay her debt quickly.

“She went and told the man of God, and he said, ‘Go, sell the oil and pay your debt, and you and your sons can live on the rest.’” (2 Kings 4:7)

Photo Credit: Thinkstock

8. Consolidate Debts

Once you’re on the road to an economically-stable future, help yourself along by consolidating debt with a single repayment method. Take advantage of balance transfer offers from your bank or credit card and assure yourself you’ll never lose track of payments as the balance whittles down.

“Now that we’re on the right track, let’s stay on it.” (Philippians 3:16)

Photo Credit: Thinkstock

9. Research Options

While you prepare your new budget, look into the possibility of lowering rates for line items such as auto and home insurance. Many companies offer competitive bundle pricing if you purchase plans together.

If you are paying off a government-issued student loan, research qualifications for repay options that may be more suitable to your current circumstance. Income-based plans calculate monthly payments based on salary, not the amount originally borrowed.

“Where there is no guidance, people fall, but in an abundance of counselors there is safety.” (Proverbs 11:14)

Photo Credit: Thinkstock

10. Save for a Rainy Day

Now that debt no longer holds power over your life in Christ, take a lesson from Joseph in Genesis and start an emergency fund. Make a goal of putting aside approximately three months of living expenses, just in case. Years of abundance are often followed by years of famine.

For more debt and money management resources, you can sign up for one of our finance newsletters, or check out our regularly updated Finance channel on Crosswalk.com.

Sarah Landrum is a freelance writer on a mission to change the world and help people live happier, more enriched lives. She is also the founder of the career and happiness site Punched Clocks.

Photo Credit: Thinkstock

Originally published October 11, 2019.