Kids and Allowances: What to Do?

Kids. You can’t live with them! No matter what you do, or how you do it, your 12-year old rocket scientist has a DNA designed to make you feel like you're wrong. When I present the No Debt No Sweat! Christian Money Management Seminar, I get lots of questions from lots of parents about lots of money issues. I’d like to address one of the issues that typically rattles parents: allowances.

There are about as many opinions on the subject of allowances as there are parents. Some parents believe in allowances while others don’t. Some parents tie allowances to certain chores the kids are expected to do, while other parents believe allowances should be free gifts. One survey indicates that over 80% of sixth graders do some chores for their allowance.

Allowance amounts also vary widely. Some allowances are pathetic pittances while others are big enough to make a down payment on a Florida condominium. The High School Awareness Survey reports that the median allowance is $11.00.

With so many possibilities out there, parents can get a headache when it comes to dealing with allowances. Let me share a few broad suggestions that may simplify your planning:

1. The parents should decide the amount and purpose of the allowance. I recently ran across the results of a survey conducted by Kids’ Money that said the average weekly allowance for 12-year olds is $9.58. For 16-year olds it’s $17.84, and for 18-year olds it’s $40.10.ii I don’t know about you — but that’s a lot more than we gave our 12-, 16-, and 18-year old kids!

My point is simply that the amount and purpose of an allowance is a personal matter to be determined by the person who pays that allowance — you. While there certainly is nothing wrong with soliciting the children’s input — remember, it’s your money! Do with it what your feel is best and right for your family. Don’t let the inmates take over the asylum!

2. Be clear what the allowance is, and isn’t, for. If it’s a weekly gift — great. But if you tie its payment to certain chores the child is required to do — be clear about your expectations.

3. Stick to your guns! If you begin by requiring that certain jobs be performed in order to receive the allowance — then respect your child enough to pay the allowance only when the jobs have been completed.

Some parents think that by backing down they’re showing love to their children. Unfortunately, kids often see this as softness and weakness. They soon learn that there are no absolutes — with enough pleading they can get their way. If a child doesn’t learn about responsibility and boundaries at home, he’ll either learn about them the hard way in the real world, or he’ll spend his life as a drain on society.

4. Avoid advances. As long as there have been allowances, kids have been asking for advances. I would encourage you to avoid this trap. If you really want to raise a child who will see nothing wrong with living on borrowed money and credit cards as an adult — allowance advances are a great way to reinforce this behavior.

5. Expect children to do some of the household chores without any form of financial payment. Kids need to learn that running a household is a big job. As a part of the family they should contribute to the welfare of the whole family. In our experience, this has helped our kids develop a level of self-respect. They know the rest of the family depends on them in some way. This has helped us enjoy a wonderful closeness and inter-dependence as a family unit.

6. Be consistent. Once you establish a payday, make it a point to have the money ready on time.

____________________________________________________________

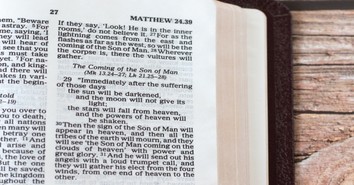

Steve Diggs presents the No Debt No Sweat! Christian Money Management Seminar at churches and other venues nationwide. Visit Steve on the Web at www.stevediggs.com or call 615-834-3063. The author of several books, today Steve serves as a minister for the Antioch Church of Christ in Nashville. For 25 years he was President of the Franklin Group, Inc. Steve and Bonnie have four children whom they have home schooled. The family lives in Brentwood, Tennessee.

• What you can do today to get out of debt and kill the Debt Monster

• A,B,C's of handling your money God's way

• How to save, invest, and retire wisely

• How mutual funds work

• How to stop fighting over money

• What to teach your kids about money

• Learn how home & car buying, college financing and insurance work.

• How to develop a budget that works -- forever!

• Features simple charts, graphs, and easy-to-use forms.

Click here to learn more or to order.

Originally published February 05, 2007.