Reviewing The Wealth Equation

Published

Sep 21, 1999

"Knowing that there is a higher power, that God is looking out for you and is on your side at all times, that he loves you . . . helps immensely."

-Scott Johnston, Sterling Johnston Capital Management

You would probably never guess that the above quote was featured in a book on investing. It may surprise you more that the publisher is a mainstream company and that the book is only available in secular bookstores.

The book is called The Wealth Equation and it outlines an intriguing approach to investing that allows you to factor in your personality type with your investment strategy. Its author, Peter Tanous, expounds on several attributes and guidelines that have emerged in his research of successful investment managers. These recommendations are called The Master Keys, and Tanous encourages individual investors to learn by the examples of the masters.

In an age characterized by the mainstream media's biased reporting of religious issues, Tanous provides a breath of fresh air by telling it exactly as he sees it, regardless of whether it seems to jive with worldly views.

Tanous presents a host of practical tips and solid advice, but there is one chapter that is especially intriguing. Master Key #6 is devoted to one of the traits that Tanous found to be common among many of the successful managers he interviewed - a strong sense of faith. With a seemingly apologetic tone over the fact that such a topic would be included in a book on investments, Tanous responsibly reports the findings of his research and proceeds to make some sense of a complex question, "Can religious faith improve your returns?"

Tanous may have inadvertently provided a floor for the secular investment world to hear the personal testimonies of some of its most successful participants. There's no doubt that his interviewees recognized the opportunity to share the importance of their faiths with a world that rarely gives them such a chance. Here are a few examples:

The most intriguing testimony is that of Foster Friess, manager of the historically successful Brandywine Fund. Tanous provides the full text of an interview in which Friess tells of his life before and after accepting Christ. It's worth reading in its entirety, but here are some excerpts:

Before: "I remained ignorant of my spiritual side, but my ignorance didn't prevent me from suffering the consequences of my disobedience to them. . . I come from a line of self-willed people. They believed that if you put in the extra effort, you could achieve anything in your control. The key was being in control.

After: "When you ask people about faith, many say they have faith in themselves. . . When people develop faith, they develop the capacity to trust others; they give up having to be self-reliant. . . I also think the ability to admit mistakes is important. In my life, before I could become a Christian, I had to recognize a need to be rescued from my own sinfulness."

Friess continues with an application of his faith in his professional life. "There's a difference between excellence and perfectionism. The Christian message rejects the notion that I must become perfect in order for me to be acceptable to God. . . Perfectionism abhors error. It tries to eradicate and destroy it. Excellence embraces error; it builds on it and transforms it. Now when something goes askew, we no longer call it a mistake or a screw-up, we call it an adjustment opportunity."

In my opinion, there are at least two solid reasons to read this book. First, Christian readers will undoubtedly be fascinated by the chapter on faith in the investment world and how it can affect your own investment strategies. Secondly, Tanous has commissioned investment and psychology professionals to create a system of determining your own "money personality." The "MoneyQ" personality model is based upon research from the Myers Briggs Type Indicator and will leave each reader with a greater awareness of their investment tendencies.

By taking the test included in the book, you can identify your "MoneyQ Profile," which illustrates the differences between individual investors in their approaches to risk, financial planning, asset allocation, and a host of other issues which impact investment behavior. Each profile contains two parts, the first being identified as one of four colors, and the second as a modifier for each color. As a real life example, if a Blue Innovator (which has the highest possible risk tolerance) is married to a Gold Conservator, (which is at the opposite end of the risk tolerance spectrum) these two profiles will have a difficult time marrying their investment styles.

But the identification of your MoneyQ profile is just one factor in determining your overall investment strategy. Another short test determines your MoneyQ2 score on a scale of aggressiveness based upon such factors as your time horizon and investment objectives. Once you combine the Q1 and Q2 profiles, you can use the portfolio recommendations provided for your individual investments. Tanous enlisted Gregory Leekley, Director of Investment Management for TeamVest, to create an array of asset and style allocations designed to fit each profile.

Tanous directs his book to those investment war veterans, who "haven't given up yet; for those who are still eager to learn the truth about investing; not only what really works but what it is that works for them." The book takes strides in explaining the reasons behind our individual investment tendencies and arms the investor with a valuable self awareness of potential areas of growth and dangers. In addition, Tanous's candid research on issues such as the role of faith provides insight into the source of absolute truth. In fact, it may be more truth than Wall Street ever imagined.

Click here to purchase The Wealth Equation or to contact author Peter Tanous.

-Scott Johnston, Sterling Johnston Capital Management

You would probably never guess that the above quote was featured in a book on investing. It may surprise you more that the publisher is a mainstream company and that the book is only available in secular bookstores.

The book is called The Wealth Equation and it outlines an intriguing approach to investing that allows you to factor in your personality type with your investment strategy. Its author, Peter Tanous, expounds on several attributes and guidelines that have emerged in his research of successful investment managers. These recommendations are called The Master Keys, and Tanous encourages individual investors to learn by the examples of the masters.

In an age characterized by the mainstream media's biased reporting of religious issues, Tanous provides a breath of fresh air by telling it exactly as he sees it, regardless of whether it seems to jive with worldly views.

Tanous presents a host of practical tips and solid advice, but there is one chapter that is especially intriguing. Master Key #6 is devoted to one of the traits that Tanous found to be common among many of the successful managers he interviewed - a strong sense of faith. With a seemingly apologetic tone over the fact that such a topic would be included in a book on investments, Tanous responsibly reports the findings of his research and proceeds to make some sense of a complex question, "Can religious faith improve your returns?"

Tanous may have inadvertently provided a floor for the secular investment world to hear the personal testimonies of some of its most successful participants. There's no doubt that his interviewees recognized the opportunity to share the importance of their faiths with a world that rarely gives them such a chance. Here are a few examples:

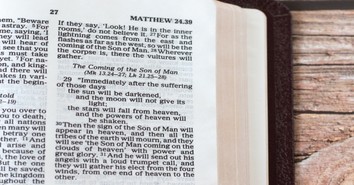

- " A manager's fiduciary responsibility is to act prudently and with the highest level of personal integrity. The Bible charges us to 'add to faith, wisdom, knowledge, perseverance, godliness, kindness, self control and love.' (2 Peter 1:5-7) These attributes will better equip the manager to successfully serve the client and meet their investment objectives."

-James C. Wadsworth, MellonBank Corp.

- "Faith dictates character, which dictates actions ."

-Thomas J. Condon, Provident Investment Counsel

- "The unalterable moral truths that are communicated through sacred scripture set the foundation upon which any business should be built ."

-Thomas J. Fox, Trend Capital Management

- "I believe (faith) helps me accept adversity as part of my life which helps lead to rational decisions. When things are going well I try to be thankful as I realize that the major events are beyond my control ."

-Jack Darrell, Darrell & King

The most intriguing testimony is that of Foster Friess, manager of the historically successful Brandywine Fund. Tanous provides the full text of an interview in which Friess tells of his life before and after accepting Christ. It's worth reading in its entirety, but here are some excerpts:

Before: "I remained ignorant of my spiritual side, but my ignorance didn't prevent me from suffering the consequences of my disobedience to them. . . I come from a line of self-willed people. They believed that if you put in the extra effort, you could achieve anything in your control. The key was being in control.

After: "When you ask people about faith, many say they have faith in themselves. . . When people develop faith, they develop the capacity to trust others; they give up having to be self-reliant. . . I also think the ability to admit mistakes is important. In my life, before I could become a Christian, I had to recognize a need to be rescued from my own sinfulness."

Friess continues with an application of his faith in his professional life. "There's a difference between excellence and perfectionism. The Christian message rejects the notion that I must become perfect in order for me to be acceptable to God. . . Perfectionism abhors error. It tries to eradicate and destroy it. Excellence embraces error; it builds on it and transforms it. Now when something goes askew, we no longer call it a mistake or a screw-up, we call it an adjustment opportunity."

In my opinion, there are at least two solid reasons to read this book. First, Christian readers will undoubtedly be fascinated by the chapter on faith in the investment world and how it can affect your own investment strategies. Secondly, Tanous has commissioned investment and psychology professionals to create a system of determining your own "money personality." The "MoneyQ" personality model is based upon research from the Myers Briggs Type Indicator and will leave each reader with a greater awareness of their investment tendencies.

By taking the test included in the book, you can identify your "MoneyQ Profile," which illustrates the differences between individual investors in their approaches to risk, financial planning, asset allocation, and a host of other issues which impact investment behavior. Each profile contains two parts, the first being identified as one of four colors, and the second as a modifier for each color. As a real life example, if a Blue Innovator (which has the highest possible risk tolerance) is married to a Gold Conservator, (which is at the opposite end of the risk tolerance spectrum) these two profiles will have a difficult time marrying their investment styles.

But the identification of your MoneyQ profile is just one factor in determining your overall investment strategy. Another short test determines your MoneyQ2 score on a scale of aggressiveness based upon such factors as your time horizon and investment objectives. Once you combine the Q1 and Q2 profiles, you can use the portfolio recommendations provided for your individual investments. Tanous enlisted Gregory Leekley, Director of Investment Management for TeamVest, to create an array of asset and style allocations designed to fit each profile.

Tanous directs his book to those investment war veterans, who "haven't given up yet; for those who are still eager to learn the truth about investing; not only what really works but what it is that works for them." The book takes strides in explaining the reasons behind our individual investment tendencies and arms the investor with a valuable self awareness of potential areas of growth and dangers. In addition, Tanous's candid research on issues such as the role of faith provides insight into the source of absolute truth. In fact, it may be more truth than Wall Street ever imagined.

Click here to purchase The Wealth Equation or to contact author Peter Tanous.

Originally published September 21, 1999.