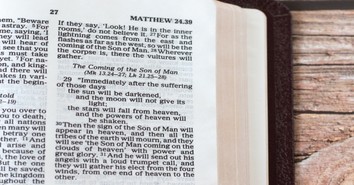

Unpacking the Financial Lifestyle of 10-10-80

This simple financial rule has been around for a long time. Some say it’s impossible to live by while others say it’s too simple of a rule for our complicated financial lives.

We’d say that even though the rule seems simple, it’s not only doable but also a great way to begin aligning your finances with your financial goals and dreams. After all, who out there would say no to a debt-free future, worry-free retirement and knowing that they’ve been able to make a positive difference in the lives of others simply through their financial decisions?

So let's unpack the 10 10 80 rule and see how we can use it as our financial compass.

As we generate income, 10 10 80 rules helps us with distributing our income in a way that would:

- Allow us to be generous with 10%.

- Provide us with a financial buffer or margin of 10%.

- Cover all of our day-to-day living expenses with the remaining 80%.

10% Generosity

We believe that generosity matters, but it’s not just our opinion. Statistics show that those who give of their time and resources are happier, healthier and live a much more fulfilled life. In a recent article by Huffington Post titled Habits of Supremely Happy People, generosity (spending money on other people) was among top habits.

So we encourage you to make giving a priority. It will not only increase your chances for a happier and healthier life, but it will also give you a better perspective on your own financial circumstances and will allow you to have the right perspective and relationship with money.

Here are few ideas on how to make generosity part of your financial journey:

- Give before you spend rather than after the fact.

- Decide as a family what matters to you most and make giving a family-wide affair. Let your children participate in the act of giving and talk about generosity and why it matters at your dinner table. Choosing to give to the right cause will make it that much more meaningful.

- Giving often is sacrificial, so take a look at your spending habits and see if there are ways to curb spending in certain categories or maybe cut one out completely in order to give. Again, work as a family to find ways to give.

- Participate in projects with your charities of choice. This is a great way to become more engaged and experience how your monetary gifts are being used to help others.

10% Saving & Investing

Creating a financial safety net and financial margin is critical to the well being of your finances. Without making it a priority, you’re in danger of living from paycheck to paycheck and always having to fall back on debt in order to cover life’s unexpected turns.

Instead of saving leftovers, make it a priority and an automatic must before you start spending your paycheck. Saving 10% of your gross income every month will allow you to build solid financial footing, will give you much needed peace of mind and will help you prioritize long-term financial health over fulfilling short-term financial wants. Here are practical ways to make this happen:

- Open a savings account and ask your bank to put withdrawal limitations on that account. This will make it harder for you to tap into those saved funds.

- Ask your employer / HR department to split your paycheck and designate 10% off the top to go into that specific savings account.

- If your employer offers a matching 401k, then use a portion of your 10% to go into that retirement fund and a portion to go to your savings account.

- Create a list of short and long-term financial goals. Assign a specific amount and a specific due date to each of those goals. Focus on building your $1000 emergency fund first, then on having 1 full month of living expenses set aside, and then, ideally, on having a 3-6 month living expenses fund.

If you’re looking for creative ways to save money, here are few ideas to get you started! - Don’t forget to celebrate! Every time you meet another savings goal, celebrate that milestone as a family. Whether it’s a nice dinner or a special get away, make goal achievement a memorable event. It will help you see that your sacrifice is worth the effort and that you can still enjoy life even while on a saving journey.

80% to Live on!

None of us should consume 100% of our monthly earnings. If we do that, it spells trouble not only for today but also paints a grim outlook for our financial future.

By limiting our consumption to 80% of our gross income we are able to set right financial priorities for both right now as well as the future.

In order to set financial limits, you’ll need to understand what areas of your monthly spending are “in trouble” – consuming much more of your monthly income than they should.

Usually, housing is an area that many of us spend much more on than we should. In general, if you spend more than 25% – 30% of your gross income on housing, your budget will have to experience cuts in other areas in order to compensate for that expense.

Transportation, especially high car payments, are second in line and should be revisited with care to see if cuts are in line.

Struggling with high transportation cost? Here are few ideas on curbing your spending in this budget category.

Food is the 3rd highest expense and without paying close attention to it, it can get way out of hand.

Here are 3 ways you can eat well and still save big!

Your budget will also have many “discretionary” areas that are non-essentials but we treat them as though our life depended on them. High cell phone plans and expensive phones, expensive cable packages and subscriptions to health clubs and magazines or periodicals will eat into your budget if you’re not careful.

So as you sit down to work on your monthly budget, write down the amount equal to 80% of your income and start listing all of the areas you spend money on. Evaluate each expense in light of essential or non-essential, and whether your current level of spending will require cuts in other areas.

As you can see, the 10 10 80 rule, though simple, gives us a great direction for realigning our financial priorities.

It will, no doubt, require some “financial gymnastics” in order to make your numbers work. Many of you won’t be able to do it right off the bat. If that’s you, it’s ok, as long as this is the direction you’ll be taking your finances. So here’s to all of us living by and enjoying the benefits of 10 10 80 rule!

Megan Pacheco is a writer and content manager for Finicity (provider of Mvelopes and Money4Life Coaching). She comes with 13 years of experience in the area of personal finances and her tips on budgeting, debt, saving, giving, money and marriage and more have been published by Yahoo Finance, AllParenting, FoxBusiness, DailyFinance, REDBOOK and others. You can contact megan at: megan.pacheco@finicity.com

Publication date: May 16, 2014

Photo courtesy: ©Pexels/burst.shopify.com

Originally published April 12, 2019.