How Can We Rebuild Our Credit Score?

Dear Deborah,

How can I rebuild my credit score? My husband and I were unemployed for awhile and our finances went downhill. We are no longer unemployed. Thanks. -- Mary

It’s good that you and your husband are employed now. This will make it easier for you to improve your financial situation.

Lower credit scores can mean you pay more for loans and insurance. They may even affect your chances of getting certain jobs. Additionally, many credit card companies increase your interest rate if payments are late with another creditor.

We know that, in general, the better your credit score, the more likely you are to pay a lower rate.

Two quick things you can do to raise your credit score:

1. Pay your bills on time.

2. Pay off a balance.

Two big ways to lower your credit score:

1. Send your credit card or loan payments late.

2. Have high outstanding balances. Lenders are aware that the more debt you have, the harder it will be to pay the bills if there’s a job loss, sudden illness or divorce.

Just one late credit card payment can affect your score negatively. MoneySmart reports that “people with one late or missed payment in the past year have average credit scores about 160 points lower than those with clean records: 598 for one late payment vs. 759 for no late payments,” USA Weekend.

According to ZeroCreditReport.com, credit bureaus include the following on their credit reports: court records (bankruptcies, liens, judgments), collections (paid or unpaid accounts), merchant trade lines (credit lines, department store cards, auto loans, mortgages, credit cards), and inquiries.

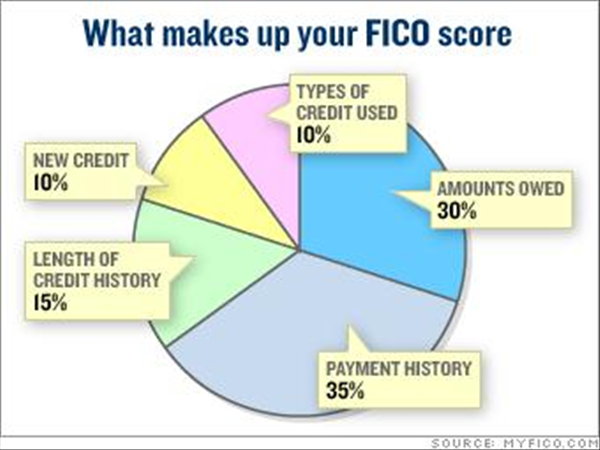

Most lenders refer to an elaborate numeric system put together by Fair Isaac Corporation.

FICO scores range from 300 to 850, with scores above 700 considered acceptable. To know your credit score contact Fair Isaac Corporation at www.myfico.com or call 800-342-

6726. You will be asked to pay a small fee.

For a credit report from the major credit bureaus, go to www.annualcreditreport.com or call 877-322-8228.

Remember that a good credit score is made over time.

Deborah Nayrocker writes on personal money management topics, showing others how to take control of their financial future. An award-winning writer, Deborah is the author of The Art of Debt-Free Living and the Bible study Living a Balanced Financial Life. Her Web site is www.ArtofDebt-FreeLiving.com.

Originally published May 11, 2018.